The price of whiskey is soaring these days. In fact, rare whiskey from Ireland, Scotland and Japan has never been more valuable than it is today. But these astronomical costs certainly don’t apply to everything hitting the bottle. While some whiskey is now more expensive than a luxury sports car, there are liquids that cost as little today as they did decades ago. So, what goes into the price of whiskey? And if you’re looking to make a smart whiskey investment, how can you tell that what you’re buying now will rise in value tomorrow? We’re glad you asked. Because we have some expert answers. These are the most important things to consider when seeking out a collectable whiskey and the best whiskey to buy for investment.

The Distillery That Crafted It

You’ve probably heard of some of the biggest players in the industry: The Macallan, The Dalmore, Pappy Van Winkle, Yamazaki, Midleton. But there are plenty more that you haven’t heard of which are also high on the list of collectors. If it comes from a mothballed distillery, such as Port Ellen or Brora, for example, then it’s going to be astronomically expensive for good reason: they’re not making any more of it. For a smart whiskey investment, you’re hoping to find something that hasn’t caught on with investors…Yet. And the easiest way to predict whether or not an upstart or newer distiller is going to go the way of The Macallan is to look at the people making the whiskey there, and take note of whether or not any accolades are pouring in.

Bladnoch whisky, for example, is a single malt producer in the lowlands of Scotland which recently recruited Dr. Nick Savage as their master distiller. They plucked him from The Macallan. And ever since he made the switch, experts have been admiring the liquids coming out of this heretofore dark horse whiskey distillery. You can reasonably expect whisky collected from there today to be worth more in the years to follow.

Rewards Follow Awards

When it comes to the significance of awards, we needn’t look any further than the subcategory of Japanese whisky. As recently as 2013, bottles of Yamazaki were collecting dust on bottle shop shelves. Then in 2014, whiskey writer Jim Murray named Yamazaki Sherry Cask 2013 the Best Whisky in the World. Suddenly there was a run on the liquid. And when people couldn’t find any of that specific bottling on the shelf they started trying other Japanese whiskies and it wasn’t long until it became one of the most sought after styles on the planet. Today that bottle of Sherry Cask 2013, which was initially selling at less than $200 is worth more than $18,000!

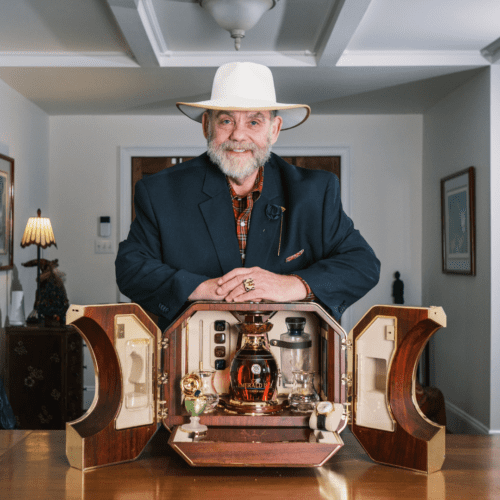

Make sure to keep current on who is winning the most notable accolades each year. And of course, The Craft Irish Whiskey Co. is a good example, having just taken the prize for world’s Best Irish Single Malt at the World Whiskies Awards for The Devil’s Keep —our inaugural release and the first one entered into this international competition. We’re already seeing increased demand for this whiskey and others from our portfolio and expect this to continue as the recognition continues to accumulate.

Location, Location, Location

This one is fairly straightforward, but it’s worth stressing. Collectible whiskey comes from places that are associated with great whiskey. Kentucky, Ireland, Speyside and Islay in Scotland and, more recently, Japan—these are the parts of the world that whiskey connoisseurs think of when they’re thinking about whiskey. And general consumers are just the same. In terms of emerging markets, three regions to watch are India, Australia and Taiwan. You can still find plenty of well-matured single malts from these areas at relatively low price points. And a multitude of producers from these specific regions are starting to gain traction with the same awards we just mentioned.

The Way In Which It was Made

Making whiskey is a time-honoured craft which is mastered over the ages. Not all whiskey distilleries are up to the task. If you want to ensure that your whiskey is worth collecting, take a closer look at how it is made. Is it a single malt or a blend? The former category is more of an appreciable asset than the latter. What type of whiskey cask wood was used in the maturation process? Sherry butts are the preferred cooperage for many collectors. Yet that’s just one style amongst so many. There are myriad sorts of precious wine barrels that impart all kinds of elegance and sophistication into whiskey: Amarone, Sauternes, Port—just to name a few. And it doesn’t have to be oak. Cherry wood and chestnut are both capable of creating some incredible flavours in whiskey and they are also less commonly used, meaning that they will significantly enhance the rarity of any spirits they hold.

Another consideration is the proof at which the whiskey batch was bottled. Cask strength (or barrel proof) whiskies are those which were not watered down after the ageing process. They tend to hover over the 50% ABV mark and are generally more coveted by whiskey collectors. Though it’s not a guarantee of the liquid itself, there does tend to be a correlation between the strength of a whiskey and its potential investment value—as modern connoisseurs are compelled by cask strength.

How Much Of The Whiskey Exists

This is a crucial thing to consider when delving into whiskey investment. Here’s what The Craft Irish Whiskey Co.’s founder, Jay Bradley, has to say on the subject: “Whiskey is a difficult and expensive thing to make, so distilleries recoup their costs by producing lots of it. Jameson’s — the most popular Irish whiskey brand in the world — churns out more than 30 million bottles every year. Even a mid-shelf single malt like Glenmorangie will shift around 10 million bottles a year. While the whiskey might be good, it’s never going to rise in value significantly because there’s so much of it on the market.”

In other words, you want whiskey that was crafted with care, but not liquid that is flooding the shelves across the globe. Maybe you’ve heard the term “small batch whiskey production.” It sounds like a good thing, and it usually is: whiskey made by mixing the contents of a relatively small number of barrels, deemed of the highest merit by a respective distiller. This methodology is likely to help keep overall output at a lower level. And we see it most typically in the world of Bourbon. But now small batch Irish Whiskey and Scotch are starting to make an appearance on shelves. Try and observe how ubiquitous these particular bottlings are when considering the whiskey appreciation implications.

Then there are those shuttered whiskey distilleries which we talked about before. Port Ellen and Brora are notorious examples. But some are less known to the general public; names like Ladyburn and Rosebank in Scotland. Karuizawa in Japan.

At the end of the day, whiskey value and rare whiskey investment is contingent upon so many variables that it’s impossible to predict appreciation with absolute certainty. That’s fine, because nothing in this world is absolutely certain. The best we can hope for is to assess these variables, identifying the patterns inherent to the whiskies that have already soared in price. Then we can get a better sense of the fair market value of each whiskey on shelf today to better predict how it will perform into the future. The more you educate yourself, the more the odds will be in your favour. Sláinte and happy hunting!